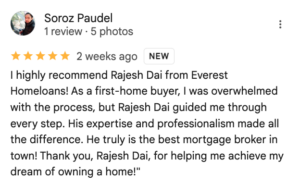

4.9 / 5.0 on

- Google My Business

- Learn More

Your Path to Property Ownership

Transform your homeownership dreams into reality with Rajesh Kandel’s expert mortgage solutions. We craft personalized financing strategies that align perfectly with your property goals.

Happy Customer

Refinance My Loan

Buy My First Home

Milestone Achieved over the past 7 years+

0 +

Happy Customers

0 +

Home Loans Approved

0 M+

Loans Settled

0 %

Customer satisfaction

Collaborating with 30+ Lenders for Your Home Loan Solutions

Your Trusted Mortgage Partner

When it comes to securing your dream home, we’re more than just a mortgage broker – we’re your dedicated financial partner. Our award-winning team combines deep expertise with personalized service to deliver superior lending solutions.

Local Expertise, Cultural Understanding: Your Nepali Mortgage Specialist

Why Rajesh Kandel ?

Why Everest Home Loans ?

We provide personalized professional service with diverse loan options tailored to your specific needs. Our expert team, backed by years of industry experience and professional qualifications, will guide you to make informed decisions based on your financial requirements and situation. Our service excellence is validated by multiple industry awards, ensuring you can trust in our quality service delivery.

First Home Loans

We can help you get the keys to your First Home and make the process as seamless as it can get.

Land and Construction Loans

If you are looking to buy land and build your property from scratch, we can help you throughout the journey as the construction picks up until your home is complete.

Investment Home Loans

Let’s build your Investment portfolio. We will help you get the perfect loan that fits with your financial goal.

Refinance Home Loans

Refinancing is the process of replacing an existing loan with a new one under different terms. Here are the main types of mortgage refinancing options:

Self Managed Super Fund loan

A Self-Managed Super Fund (SMSF) loan enables you to borrow money through your superannuation fund to purchase investment properties.

Scalable Services

Ensuring seamless growth and adaptation to your evolving needs.

FAQ

Frequently Asked Questions

Browse through our frequently asked questions to find quick answers to your queries. Got more questions? don’t hesitate to contact us.

Are you a licensed mortgage broker?

Yes, we hold an Australian Credit License (ACL) and are members of professional industry bodies like FBAA and MFAA. We maintain the highest standards of training and comply with all government regulation

Do you charge any fees for your service?

Our services are typically free as we are paid by the lenders through commissions. We receive between 0.33% and 0.85% upfront commission and 0% to 0.285% ongoing commission of the loan amount

How much deposit do I need?

You can get a loan with as little as 5% deposit, though 20% is needed to avoid Lenders Mortgage Insurance (LMI). Guarantor loans may require no deposit. The exact amount depends on your circumstances and the lender’s requirements

How many lenders do you work with?

We have access to over 40 lenders, including major banks and specialist lenders, ensuring we can find the right loan for your specific situation